40+ How much can i borrow va loan calculator

Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. All calculations and costs are estimates and therefore Guild Mortgage Guild does not make any guarantee or warranty express or.

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

As of 2022 FHA loan limits range between 420680 to 970800.

. For example a 30-year fixed-rate mortgage has lower payments but youll end up paying more in interest. And shop around to ensure you get the best deal on a loan. Click here to check todays low VA loan rates and see if you are eligible Sep 16th 2022 VA funding fee charts.

It usually takes just one to three days and can be done online or over the phone. VA home loans are exclusively given to active military members veterans and. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value.

Veterans Affairs backs VA loans. When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value. Generally 41 to 43 up to 50 is possible VA loan.

457 Savings Calculator Overview. The cons of a loan that lasts decades longer has over double the total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount. This calculator is offered for illustrative and educational purposes only and it is not intended to replace a professional estimate.

Your mortgage will then amount to 240000. This will help you determine if you can afford a shorter loan or if its better to choose a 30-year term. We assume homeowners insurance is a percentage of your overall home value.

Up to 43 allowed but 36 to 41 is preferred. Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments. Suppose you bought a 300000 house and offered a 20 down payment worth 60000.

You to repay the money you borrow can significantly impact your interest costs. But predicting how much of a nest egg youll eventually be able to end up with is challenging. 41 is typical for most lenders.

VA home loan applicants can pay all or part of the fee in cash or roll the fee into their loan amount to reduce out-of-pocket expenses at loan closing. A 457 savings plan is a great way to save for retirement if youre fortunate enough to qualify for one. A calculator does the math for you so you can quickly analyze different loan types.

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. How much can you borrow from the FHA. We use current mortgage information when calculating your home affordability.

With each subsequent payment you pay more toward your balance. Delinquency Rate edit The delinquency rate was 638 of all mortgage loans outstanding at the. The following table shows loan balances on a 200000 home loan after 5 10 15 20 25 30 35 40 45 50 years for loans on the same home.

This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible. Remember that lenders will still impose a maximum amount you can borrow often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value.

The lender then takes the property and recovers the amount of the loan and also keeps the interest and principal payments as well as loan origination fees. To know how varying loan terms affect the cost of your mortgage lets review the following example. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Calculator results do not reflect all loan types and are subject to individual program loan limits. Know Your FHA Loan Limits.

41 is typical for. T he charts below show VA loan funding fee amounts for different borrowers. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40.

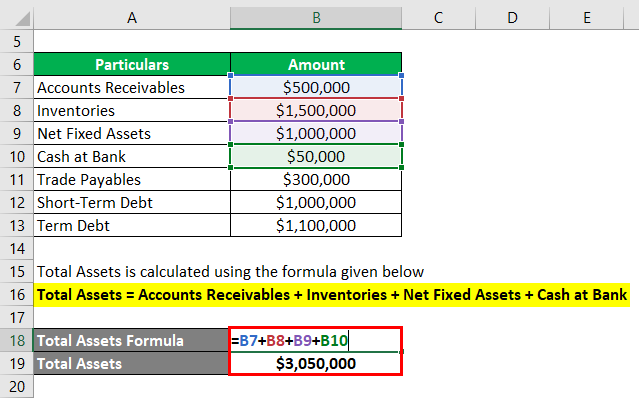

Debt To Income Ratio Formula Calculator Excel Template

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Net Worth Formula Calculator Examples With Excel Template

10 Best Installment Loans Online For Bad Credit With No Credit Check

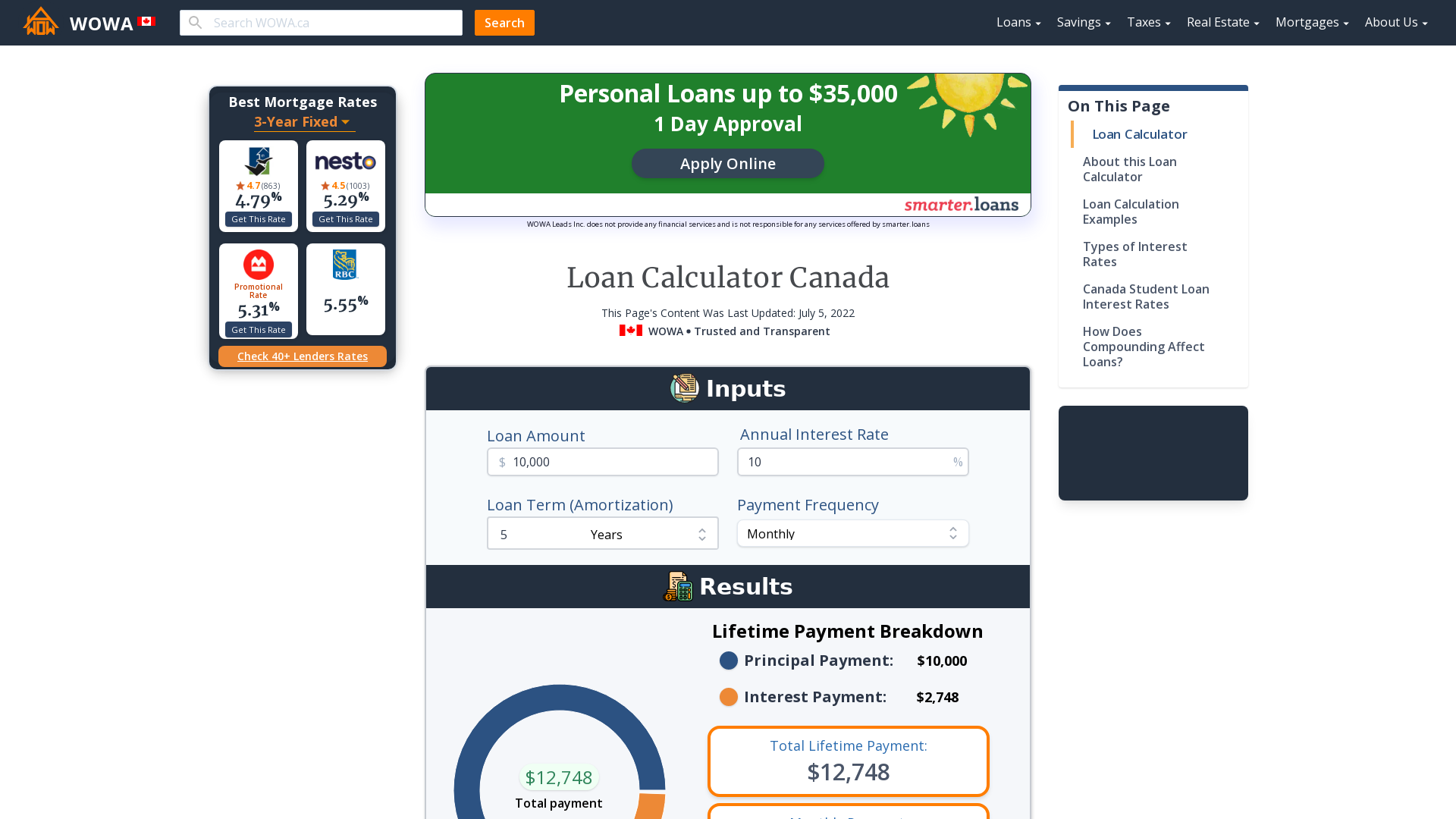

Loan Payment Calculator Wowa Ca

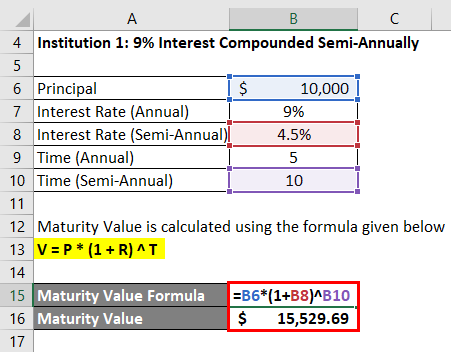

Maturity Value Formula Calculator Excel Template

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

How To Use A Mortgage Calculator Comparewise

Bfiltqjc Ibeqm

Celsius Lowers Crypto Stablecoin Loans To 100

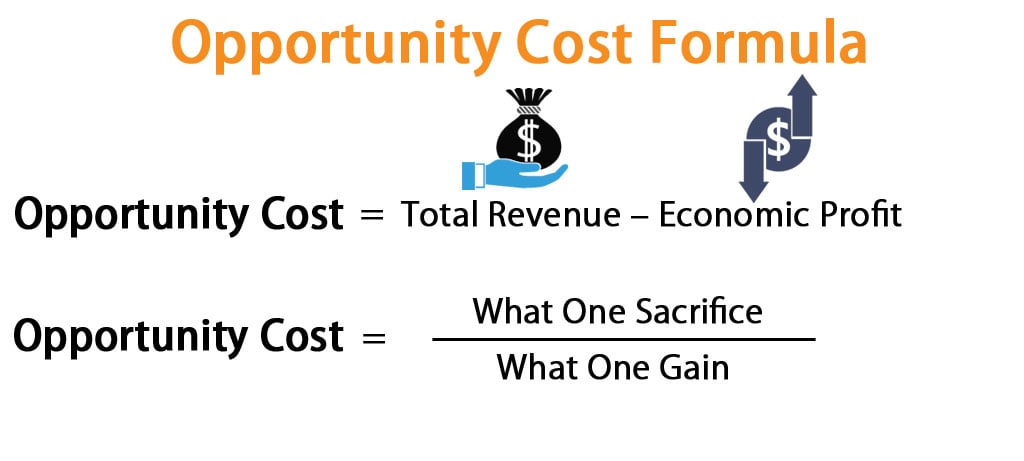

Opportunity Cost Formula Calculator Excel Template

Payroll Calculator Template Free Payroll Template Payroll Templates

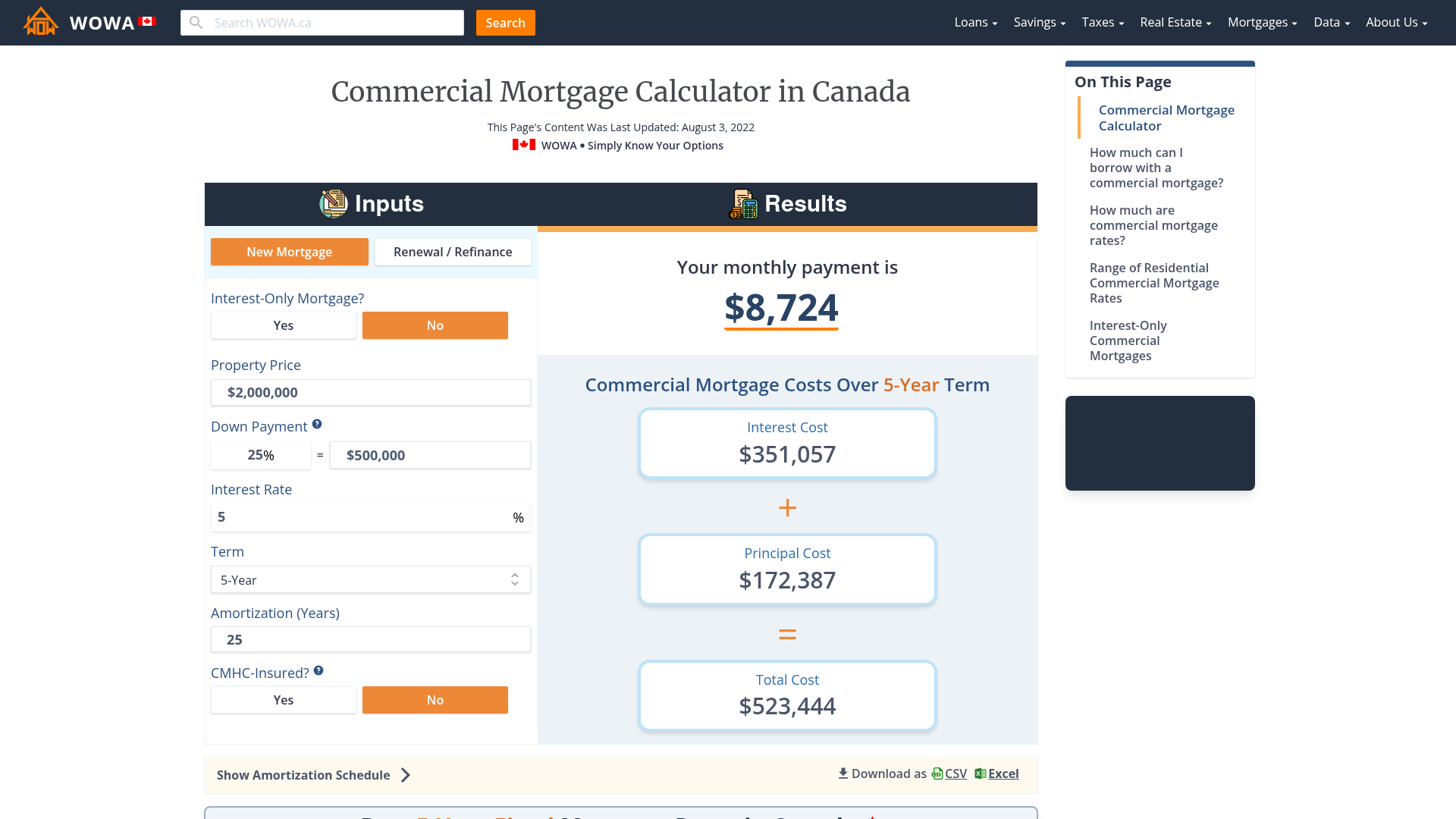

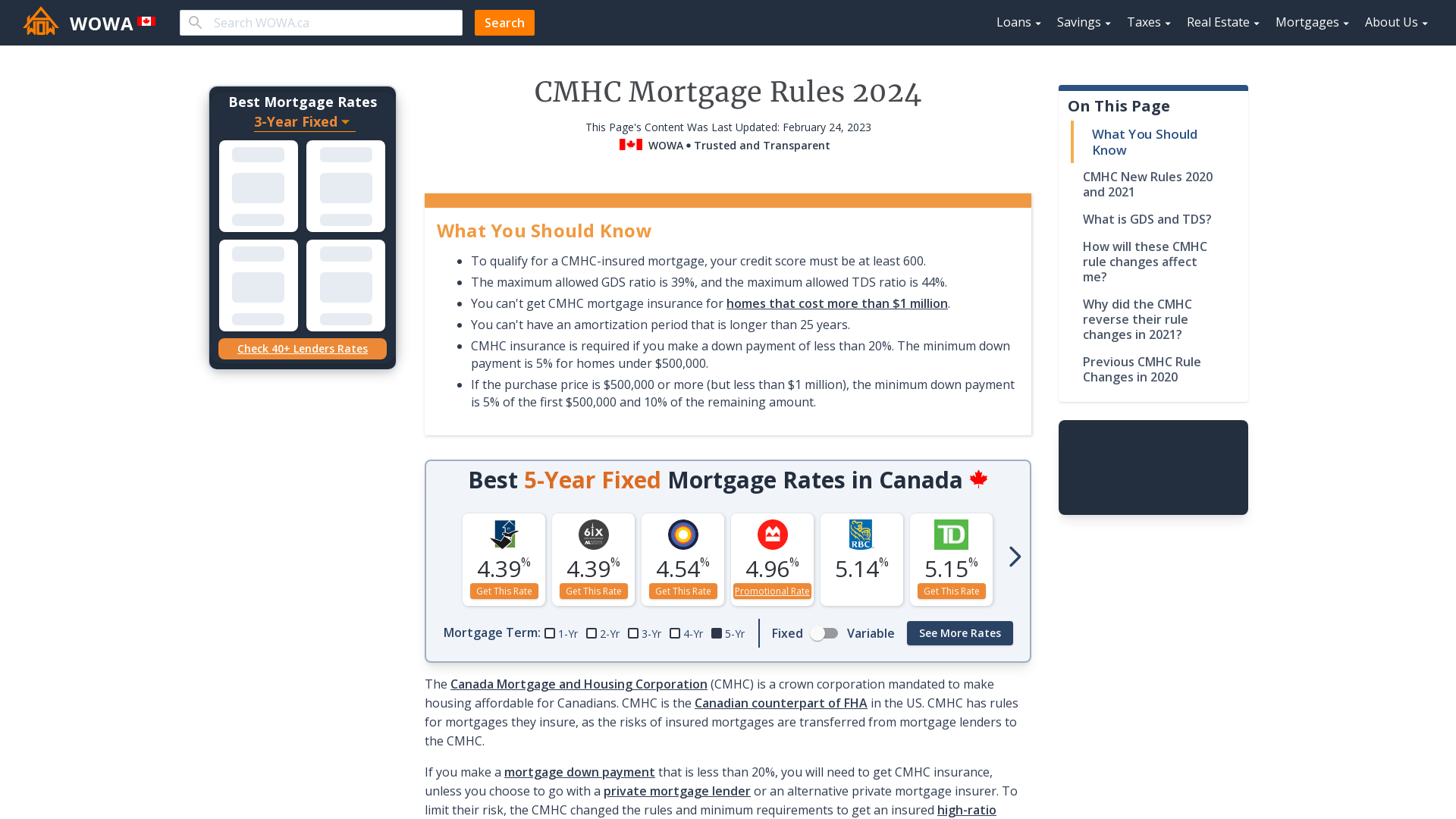

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Ssjtafrpq7xz M

What Is Home Equity Wowa Ca

Yske79mqso4p4m

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog